Green Products Continue to Punch Above Their Weight Class

Consumers are holding companies to higher sustainability standards and backing up that demand with their wallets. According to a 2023 report by Deloitte, 69% of UK adults value companies producing sustainable packaging and products, and 30% of consumers stopped purchasing certain brands or products because of sustainability concerns.[1] A report by McKinsey and NielsonIQ finds that products making environmental, social, and governance (ESG)–related claims enjoyed more market growth from 2017 to 2022 than their conventional counterparts.[2]

Since 2015, Change Chemistry has been building a strong business case for sustainable products based on green chemistry. A recent update to a joint 2021 report by Change Chemistry in collaboration with Duke University, the NYU Stern Center for Sustainable Business (CSB), North Carolina State University, and Syracuse University shows that demand for products based on green chemistry has continued to grow.[3] This demand represents an immense opportunity for businesses.

Looking at point-of-sales data for consumer packaged goods

In 2021, Change Chemistry partnered with Randi Kronthal-Sacco, a senior scholar with CSB who has extensive experience as an executive in the consumer packaged goods (CPGs), and other researchers on an analysis looking at point-of-sales data for products that feature certifications or claims of being more sustainable.

The analysis looked at point-of-sales data for 10 categories of CPGs purchased from January 2015 through December 2019. The categories of were chosen for the products’ potential to be formulated with greener chemistry: auto wax, dish detergent, floor cleaner, household cleaner, laundry detergent, pavement deicing, pool chemicals, skin care, soap, and suntan. Each product was categorized as green or conventional on the basis of packaging claims—for example, certifications or claims of greener chemistry—that were broadly defined to capture consumer preferences.

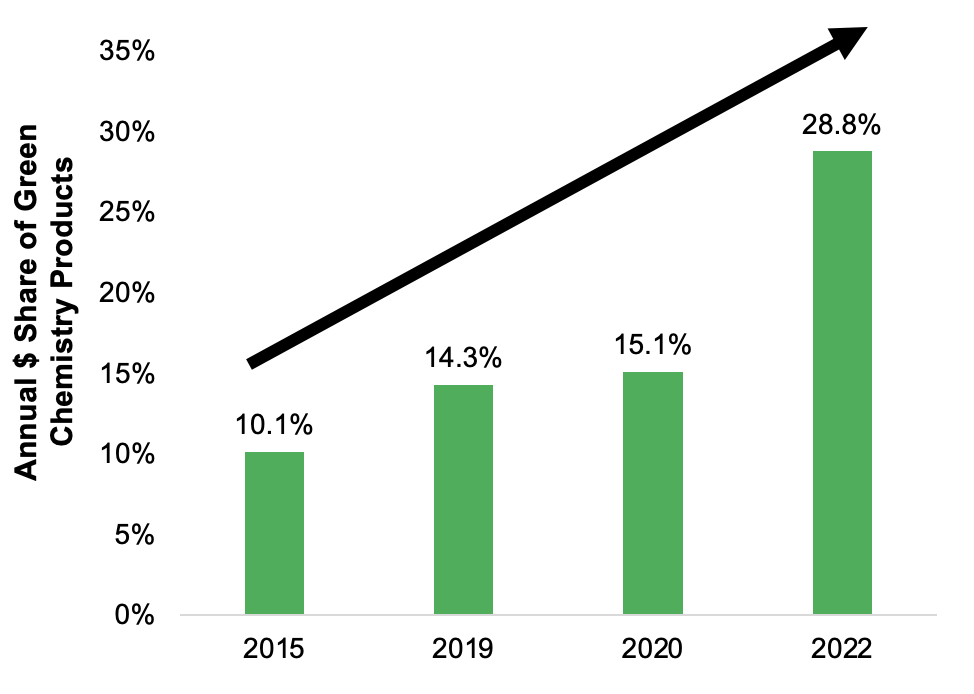

The original report found that green chemistry–marketed products accounted for a 14.3% share of the market in 2019, up from 10.1% in 2015. Yet the products delivered 62% of the categories’ market growth from 2015 to 2019. This statistic showed “greener chemistry products punching above their weight class,” Kronthal-Sacco says. Overall, green chemistry–marketed products grew 12.6× as fast as their conventional counterparts and 5.4× as fast as the overall market.

Green products clean up in the marketplace

In 2023, Change Chemistry and CSB updated the analysis with data from 2022. These four trends were visible.

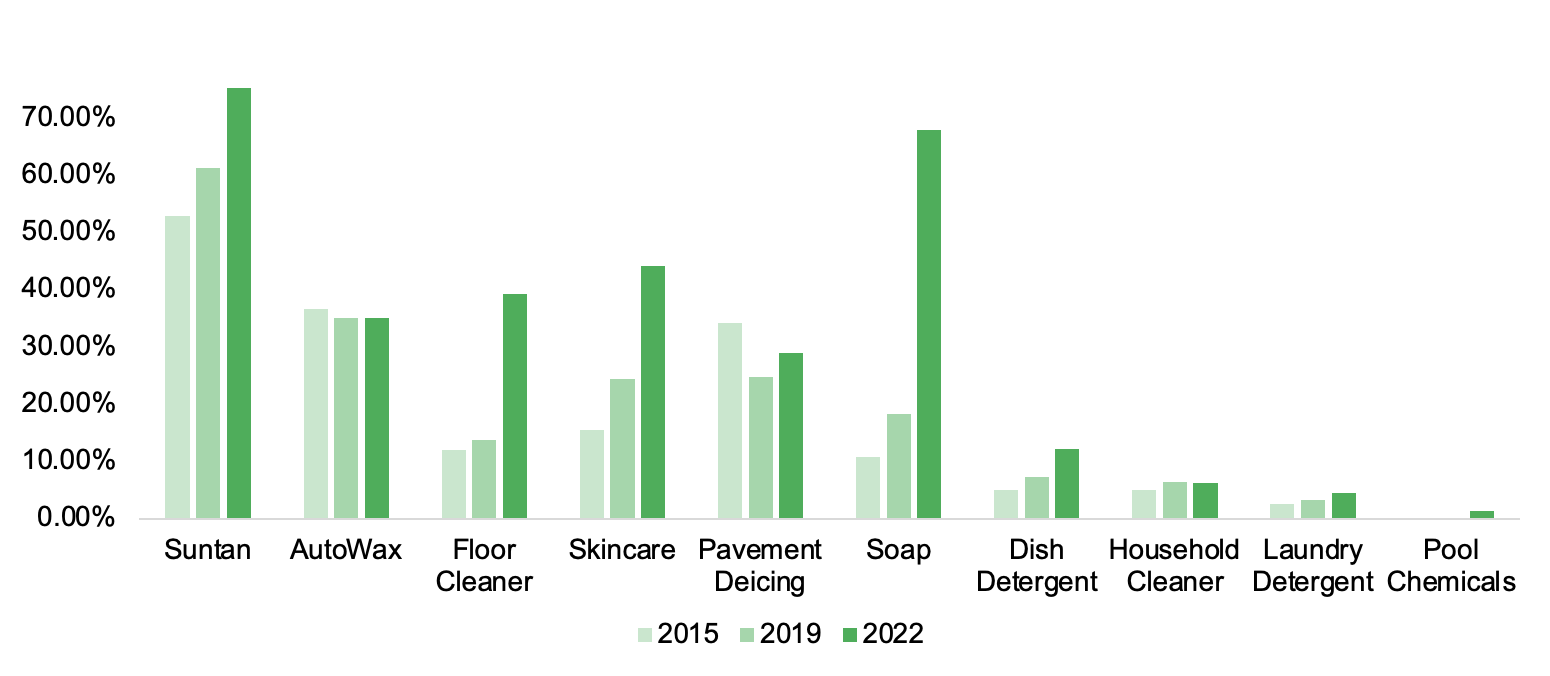

Green chemistry purchases doubled. The share of green chemistry–marketed products among the 10 CPG categories examined more than doubled in three years from 14.3% to 28.8%. The personal care categories (suntan, soap, and skin care) and floor cleaner largely drove this increase. Only household cleaners and auto wax remained essentially flat from 2019 to 2022.

Figure 1: Green chemistry–marketed products accounted for a 28.8% share of the market in 2022.

Sources: Change Chemistry and the NYU Stern Center for Sustainable Business

Figure 2: All but two categories—household cleaner and auto wax—grew their green chemistry shares from 2019 to 2022.

Sources: Change Chemistry and the NYU Stern Center for Sustainable Business

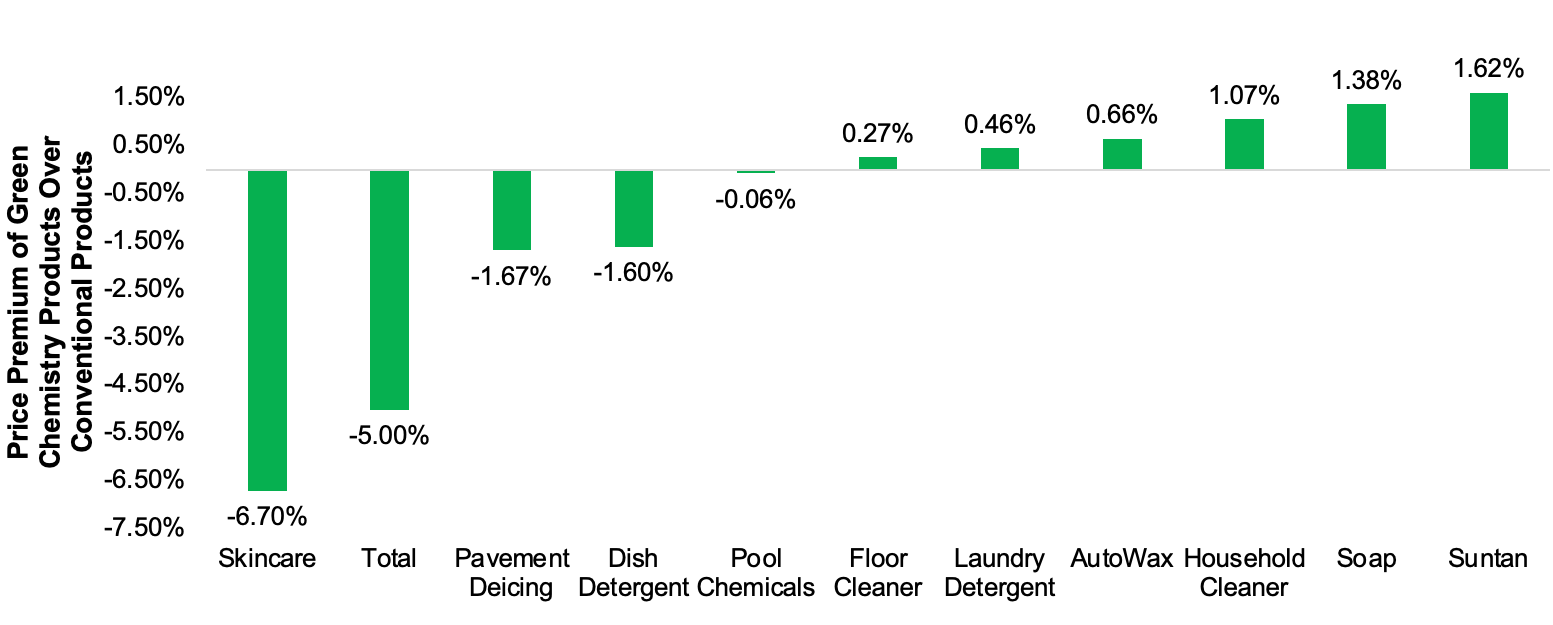

Green chemistry pricing varies. In 6 out of the 10 categories examined, green chemistry–marketed products have negligibly higher average prices than conventionally marketed products. However, this slight pricing advantage is offset by the “skin care discount.” Kronthal-Sacco attributes this discrepancy to the fact that mass-marketed products have switched to greener chemistry, while higher-end products such as retinoids and acne treatments, in some cases, have retained their conventional formulations. The average price discount across all categories is 5%.

Figure 3: Green chemistry–marketed products have negligibly higher average prices than conventionally marketed products in most categories. An abundance of mass-marketed skin care products based on green chemistry offsets that slight pricing advantage.

Sources: Change Chemistry and the NYU Stern Center for Sustainable Business

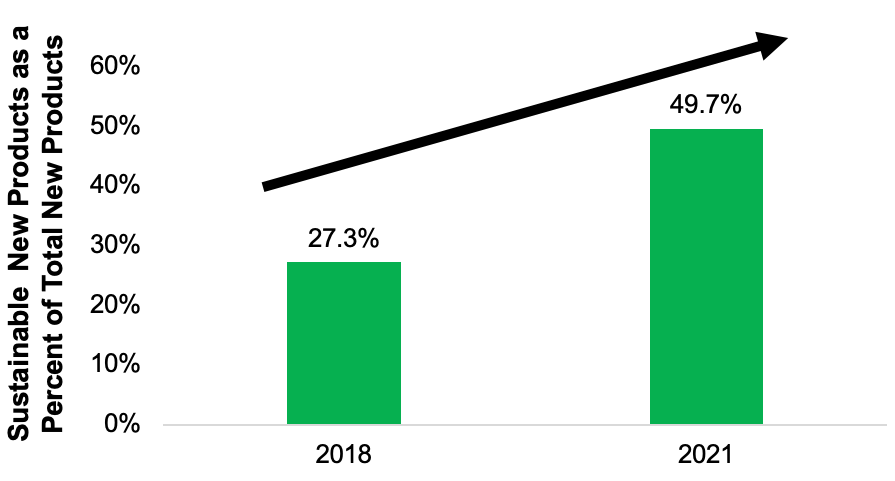

Green chemistry is central to innovation. Half of all new products launched in 2021 were formulated with greener chemistry. The number of new green chemistry–marketed skin care products largely drove this change. Additionally, $3.4 billion worth of products that were conventionally marketed in 2019 advertised new green chemistry benefits in 2022.

Figure 4: In 2021, 49.7% of new products incorporated and advertised green chemistry, up from 27.3% in 2018.

Sources: Change Chemistry and the NYU Stern Center for Sustainable Business

Everyone buys green chemistry products. Most demographics index similarly when it comes to purchasing green chemistry products. A higher percentage of the money spent on laundry detergent by people who are younger, more educated, and making a higher income went to products featuring green chemistry claims. The opposite was true of seniors and retirees, people with less formal education, and people making a lower income. These differences were slight.

Overall, green chemistry–marketed products have continued to gain traction among CPGs. The lower concentration of products based on green chemistry in high-end skin care is “an opportunity for some companies to come in with some really revolutionary green chemistry at a higher price,” Kronthal-Sacco says. Even a small change toward greener chemistry by incumbents can have a massive impact because those products have the largest share of the market.

“Our expectation is that other categories will follow the path of personal care in coming years,” Kronthal-Sacco says. Because consumers purchase them so frequently, CPGs can be a bellwether for other consumer product categories, such as appliances.

How are brands approaching the drive for green products?

“Our consumers are super interested in sustainability. They're super interested in greener products. And pretty much almost all of our brands are speaking to this,” says Al Iannuzzi, vice president for sustainability with the Estée Lauder Companies, which includes personal care brands such as Aveda, Clinique, and MAC.

Iannuzzi sees a demand for high-end clean beauty products. He says sharing formulation information more transparently builds trust with consumers. Clean beauty, which has no clear definition or industry standards, is primarily concerned with ingredients. The Estée Lauder Companies has made its Green Score methodology, which its formulators use to choose more sustainable raw materials, freely available.

“It's a must to have to address these things,” he says. “It's not just a nice-to-do thing.”

Greener ingredients sometimes cost more. But, Iannuzzi says, companies risk losing market share if a competitor comes out with a product that’s more sustainable. Some tangible and intangible cost benefits associated with sustainable products include borrowing capital at lower cost and attracting top talent. From a marketing perspective, sustainability provides an avenue for brands to tell stories that resonate with the consumer.

The products must be functional. “I don't care how green a laundry detergent is; if it's not going to clean your clothes, consumers won't buy it,” Kronthal-Sacco says. Most manufacturers now recognize that they must deliver against both sustainability and functionality.

The demand for green products is international. Consumers in countries such as Brazil, Russia, India, and China are highly interested in green products and willing to pay more for them, Iannuzzi says. The large number of people entering the middle class in China and India is likely to drive demand even further.

In addition to consumer demand, regulations and resource limitations are drivers for green chemistry. “All of these things require greener chemistry formulation, and the ones that crack it will be the ones that win,” Kronthal-Sacco says.

“We know there is going to be a greater demand on raw materials, and that alone should make us rethink the way that we bring products to market, including the use of green chemistry,” Iannuzzi says.

“Chemistry in some ways delivered a lot of the ills of our world, and chemistry also, though, can fix them,” Kronthal-Sacco says. This challenge is a “big opportunity for businesses.”

This briefing is based on an analysis conducted by the NYU Stern Center for Sustainable Business with Change Chemistry. Freelance writer and editor Alexandra Taylor wrote the article.

[1] “Sustainable Consumer Behaviour and Lifestyle 2023.”

[2] “Do Consumers Care about Sustainability & ESG Claims? | McKinsey.”

[3] Golden et al., “Green Chemistry A Strong Driver of Innovation, Growth, and Business Opportunity.”